MSCI: European Commercial Real Estate slows in Q3 2025

Europe's commercial real estate market experienced a subdued third quarter in 2025, with economic uncertainty hindering investment growth, according to MSCI's Europe Capital Trends report.

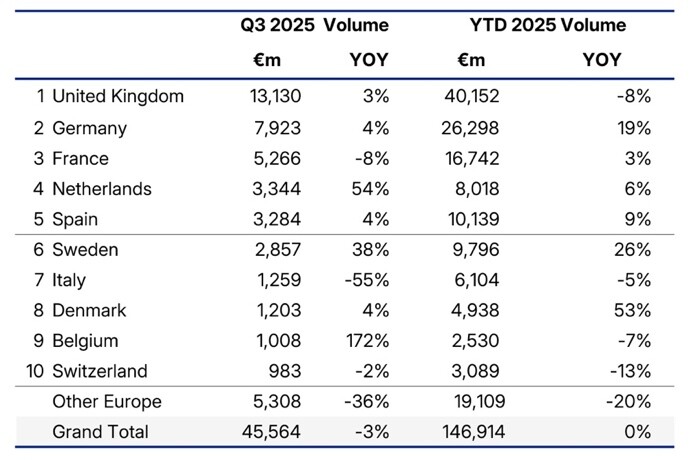

Transaction volumes totaled €45.6 bn, a 3% decrease from the previous year, marking the lowest number of transactions since 2013. Year-to-date investment, however, remained stable at €146.9 bn.

The "living sectors," such as apartment blocks and seniors housing, saw the most activity, driven by demographics and housing shortages. Apartment investments rebounded, particularly in Germany and Sweden, while seniors housing and care facilities surged by 41% to €4.1 bn.

Conversely, some office and retail segments faced challenges due to technological shifts. While shopping center purchases are set to surpass last year's volumes, they remain significantly below the 2015 peak of €32 bn. Office sales are at historic lows in most markets, though central business districts in major cities like London and Germany's "A cities" are seeing a recovery in investment and pricing.

Across Europe, transaction volumes presented a mixed picture. Most large markets, including Germany, France, Spain, Sweden, and the Netherlands, saw slight increases. The UK, Europe's largest investment market, was an exception, experiencing an 8% drop to €40.2 bn, yet still outperforming second-placed Germany.

UK investment fell 8% to €40.2 bn due to fewer residential and hotel deals. Q3 saw a 3% increase in transactions year-on-year, reaching €13.1 bn. London remained Europe's top investment destination despite a 22% drop in investment, with office transactions rising due to rental growth and value-add investors. Ireland's investment plummeted 37% to €2.0 bn, with Dublin falling 39% to €1.7 bn.

Investment in Germany grew 19% to €26.3 bn, driven by a strong Q1. Retail, residential, hotel, and industrial sectors recovered, but the office market remained weak, around 70% below the 10-year average. Office pricing in Germany's seven "A cities" stabilized. Berlin was Europe's third-largest investment destination at €4.5 bn, after London and Paris.

Commercial real estate investments in France rose 3% to €16.7 bn. Q3 saw an 8% decline in investment, likely due to economic growth concerns. Paris held the second spot behind London, with transactions up 14% to €10.1 bn. Half of Europe's top 10 single-building sales were in Paris.

The market in the Netherlands grew 6% to €8.0 bn, with a strong Q3. Q3 volumes jumped 54% year-on-year, boosted by significant purchases by Pontegadea (Zara founder's investment company). Amsterdam ranked 8th in Europe with €2.2 bn in transactions.

Sweden led the Nordic region with a 26% increase in property sales, reaching €9.8 billion. Finland's transactions rose 27% to €1.8 bn, with a threefold surge in Q3. Norway's investment market contracted 32% to €3.4 bn. Stockholm was the fourth-largest investment destination in Europe, with €3.9 bn in sales.

Tom Leahy, head of EMEA Real Assets Research at MSCI, commented: “Quarterly investment volumes have broadly settled in the same range since the start of 2023, as liquidity has been constrained by pricing uncertainty, legacy portfolio issues for some of Europe’s largest investment managers and the structural weaknesses affecting some property sectors, particularly offices. The rapidly changing policy stances of the U.S. administration have added another layer of uncertainty that has also weighed on Europe’s markets. The conditions are in place for a stronger fourth quarter, which is typically the busiest for investment activity with the pressure to deploy capital before year-end. Our data show the number of deals pending completion is the strongest since 2022, suggesting the Q4 outturn for activity may surprise on the upside.”

Commercial real estate (CRE) Media Europe is a free to access news and information service providing dependable, independent journalism. Our mission is to provide the pan-European real estate market with the latest trends and data points, and provide key analytical coverage to help you make better decisions in your business.

To discuss advertising and commercial partnership opportunities please contact eddie@cremediaeurope.com